The speed at which the projects are coming it will easily surpass the target of 20000 MW by 2022, however considering the national scenario this is grossly inadequate. Even with 20000 MW installation in 2022 the power generated will contribute to less than 3% of the total power requirement of that time. Hence the target bar needs to be raised at least 3 to 6 times the current target. Innovative financing mechanism proposed herewith has potential to raise finance for thousands of MW of solar power plants in very short span.

Problem Statement

Favorable factors for solar power projects are that the cost of PV technology is almost bottomed out. Projects provide day-power which is expensive. However cost of power is major constraints for the investment. With Rs 7 to 8 crores per MW investment in the project even a small sized project of 10 MW demands 70-80 crores of rupees. As corporate investment decisions are based on ‘Returns on Investments’. In case of Solar projects major components of annual costs are interest on capital (@14%), physical depreciation (@ 6%), and other costs like O & M, insurance etc. (@ 5%). Hence no corporate can invest in the project unless and until it can fetch ROI of around 30% in first few years. With this return on investment solar projects are not viable when compared to cost of coal based power. Even with some incentives like RPO (Renewable Power Obligation) and also mechanisms like VGF (Viability Gap Funding) still the investments in the projects is not attracting the corporate.

Roof-top installations with battery storage

These are available for solar, small wind generator or solar-wind hybrid. Cost is high @ Rs 12-18 crores per MW and with batteries coming in picture as high running cost, financially not viable. Environmental impact is also doubtful.

Roof-top or decentralized systems; grid tied

These are available primarily for solar option. In some states regulations need to change. However high cost of capital in the range of Rs 12-15 crores per MW, lower power generation (approx.. 40% less than MW scale centralized grid tied power plant) and pumping power in the grid at low voltage are the issues which makes the projects unviable.

Grid tied MW scale solar and wind projects are the only options in current scenario but still need some kind of financial assistance to make it viable. There is no role for common man, small and medium scale industries, commercial organisations etc. in participating existing schemes of projects and project financing.

Innovative Financing Mechanism, ‘Solar Power Projects with Public Participation’

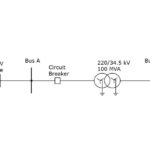

Innovator proposes a business model, wherein a corporate company, government agency (SECI, DISCOMs, MIDC, PSUs, Local bodies etc.), industry associations etc. can initiate a company. For discussion purpose this company is referred as ‘People’s Solar Power Company’. The proposed project financing innovation raises capital from residential users, small and medium scale industries, shops and other commercial organisations etc., who are also the end users of the power. Capital of the company can be raised by way of some instrument, like bonds. The innovation is that in return every investor gets his slice of power for the life of the project. This is most innovative feature of the business model to replace cash returns with power. Major cost components of the returns from the project are replaced from currency to commodity (power in this case). In addition the cash generated from the project by selling RECs and CERs can also be distributed as bonus. Fig.1 shows how a capital, power generated and cash revenue flows in such business model for a 50 MW solar power plant. The calculations are based on following presumptions.

- Capital cost: Rs 7.50 crores per MW.

- Rate of power the end user is paying:

- Rs 7 per MW.

- Power produced: 1600 MWh per year per MW installed.

- Cash revenue from CERs 0.50 Rs Per kWh and from RECs Rs 4.50 per kWh.

- Cost of power in 10th year will be Rs 24.60 per kWh and in 20th year Rs 99 per kWh.

Steps in Implementation of Project

Major stakeholders involved in the process are: The “People’s Solar Power Company”, the “Investors” and the “Distribution Company”.

Different steps in execution of project are as below.

- “People’s Solar Power Company” raises all capital from the Investors. Investors are common households consmers, shop owners, small and medium industries, municipalities, corporations, government and non-government organisations etc. Minimum bond value can be Rs 1.25 lakh or so. Bonds can get 20% tax rebate as infrastructure bonds & effective investment will be Rs 1 lakh.

- Capital so raised is deployed in setting up a ‘Solar Power Project’. Governments can take investment guarantee and the projects will be with the government as security.

- Once the project starts generating power then some part of the power is sold to pay for transmission and distribution companies for their services and some part of the power is given to compensate for T & D losses.

- “People’s Solar Power Company” will sell some part of the power for ‘O & M and insurance” and for its operations and profit.

- Balance of available power is distributed to the investors through the “Distribution Company” which maintains the account.

- There can be many small mechanisms introduced to take care of operational issues. These are the power per investor can be banked if not consumed in the same month. Bonds can be tradable commodity in the market. Bonds can be transferable to different location within the state, bonds can be sellable. In case of surplus power available with any bondholder same can be sold etc.

- There will be additional revenues by selling RECs and CERs. Part of these revenues will be used to pay the costs of transmission, distribution, insurance etc. and balance of the these revenues will be distributed between the “People’s Solar Power Company” and “Investors” in predefined proportion.

- Governments can make the investments more attractive by awarding the status of ‘Infrastructure bonds’ or extending provisions of VGF.

Fig. 1: Flow of Capital, Power Generated and Cash Revenue for a 50 MW Solar Power Plant

Who Gets What?

Returns to different stakeholders will show that the project can be a big success. With sample calculations for 50 MW solar power plant with assumptions as mentioned about following scenario emerges about the returns to different stakeholders.

The Investor

Every investor who has effective investment of Rs 1 lakh will get:

- Approx. 1630 kWh per year for next minimum 20 years.

- Cash bonus of approx. Rs 6900 per year.

The business model will freeze the cost of power for 20 years and is insulated for any price rise in the cost of power. With power cost of Rs 7 per kWh today and Rs 24.60 per kWh in 10th year & Rs 99 per kWh in 20th year, the return on investment works out to be: 18% in first year progressively increasing to 38% in 10th year and further increasing to 114% in 20th year.

People’s Solar Power Company

- Company will get: 8000 MWh of power per year for next 20 years.

- Company is expected to get Rs 8 crores per year by way of its share in sell of RECs and CERs.

Innovator

Gets royalty for his business innovation.

The Government

The Governments will get addition of thousands of MW of solar power plants in the grid, without investment of a single rupee. No subsidy required. This power is day power where we have deficit.

Transmission and Distribution Companies

These companies will get income for their usage of network. Additional power will be great help for power starved companies. Most of the power pumped in the grid will be day-power which is expensive and usage of power by bond holders will be throughout 24 hours which is beneficial to distribution companies.

Role of different agencies: Following roles are envisaged by different agencies in the proposed project.

State Government/ERCs

- Permissions for the project.

- Take investment guarantee for the investors and in return the projects will be leased with govt. as security.

- Implement RPO mechanism strictly.

- Frame some user friendly policies for purchase of green bonds by new industries, new luxury houses, corporations etc.

Distribution Company: Accept the third party sell and distribution mechanism on retail and operate the business model.

“People’s Solar Power Company”: After projects are commissioned, liasoning with distribution company and maintain accounts of investors. Work as a professional entity.

USPs of Innovative Financing Mechanism

Following are USPs of this innovative financing mechanisms.

Corporate investment projects require minimum 30% return on capital in first few years. Even gestation period of one year adds @ 20% to the capital cost. In the proposed business model there is no increase in capital cost during gestation period. Also the model survives on lower returns in initial years as all money raised is equity by end users. For investors the returns of the order of 15% in first few years is higher than what common investors get from FDRs in bank. Higher returns in later years will be highly motivating for investors.

Also there is big class of investors who are environmentally conscious and will like to have their own green power and have no other option at present. Also many small and medium scale industries, corporations and many other such beneficiaries can put in their investment for assured power for minimum 20 years. The project ensures all ‘Environmentally conscious’ investors that with their investment the project is established and their own solar power is wheeled from project site to their houses.

Transfer of bonds, selling bonds in market, banking of surplus power, sell of surplus power are some of the innovative features.

This business model is patented by the innovator and any agency like SECI, Govt. of India or State Govt., distribution companies, industry organisations etc. can have agreement with the innovator for adoption of the

business model.