Although in order to address the rapidly growing environmental challenges, the entire world is moving towards expeditious deployment of Renewable Energy (RE) – with the fast and vast expansion of RE, the proper disposal of RE-equipment has started appearing as an unprecedented challenge of a large scale.

Let us take a look at how the challenges are increasing in this field, and what kinds of efforts are being made to mitigate them in the U.S.A., and Germany. It is not only a matter of technical solutions, but also social, economic and mainly political interests are directly involved in it.

Major challenges related to RE waste disposal

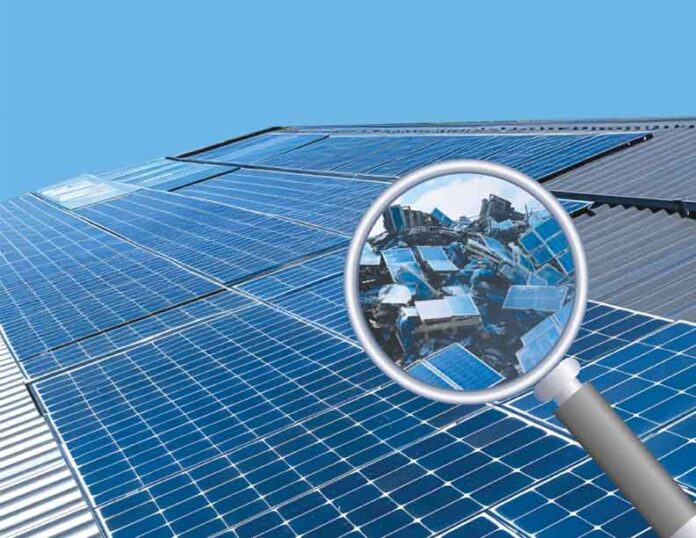

In 2025, several press releases have highlighted that the major challenges in this field include managing solar panel and battery waste, the high cost and complexity of recycling, and persistent issues with e-waste disposal. All the current announcements have primarily focused on policy frameworks and strategic collaborations to address these issues.

Challenges in solar panel disposal in 2025 include – a lack of infrastructure, high recycling costs that make landfilling cheaper and complex technology for dismantling the durable panels. In addition, there are regulatory hurdles and the environmental risk of toxic materials like lead and cadmium leaching into the environment – if panels are not recycled properly.

Also, the durable design that makes panels weather-resistant makes them difficult to dismantle and separate into recyclable materials. Existing recycling technologies, often based on shredding and thermal treatment, can release toxic gases and are not yet efficient enough for the complex layering of a panel.

More or less in the same way, challenges in used battery bank disposal in 2025 include – a lack of adequate recycling infrastructure, high recycling costs, complex and hazardous battery chemistries, unclear and inconsistent regulations, and a significant lack of public awareness and collection systems. These issues collectively make it difficult to handle the growing volume of battery waste safely and efficiently.

What is being done in the U.S.A.?

In the U.S.A., the disposal challenges of renewable energy products, primarily solar panels, wind turbines, and lithium-ion batteries are being addressed through a combination of federal initiatives, evolving state regulations, private sector innovation, and the promotion of a circular economy. However, a comprehensive national strategy is still under development, and many challenges remain.

Solar panel waste management

The federal Resource Conservation and Recovery Act (RCRA) regulates the hazardous waste and can apply to some solar panels, which contain heavy metals like lead and cadmium. On October 23, 2023, the Environmental Protection Agency (EPA) announced a new rulemaking effort to add solar panels to universal waste regulations. This would allow for streamlined collection, transportation, and recycling.

In the absence of federal mandates, some states have implemented or are exploring EPR programs that require manufacturers to fund and manage end-of-life recycling. Washington, California, New York and New Jersey have all taken steps in this direction.

Image Courtesy: We Recycle Solar

Specialised recycling companies, like SolarCycle and We Recycle Solar, are expanding facilities, particularly in solar-heavy states like California and Texas. Research is also focused on improving recycling technologies to make the process more cost-effective and efficient.

However, high costs still remain a barrier, as current recycling is often more expensive than landfill disposal.

Dealing with wind turbines wastes

The U.S. Department of Energy (DOE) has been working to address the disposal of wind turbine materials, particularly hard-to-recycle fiberglass composite blades. In 2023, DOE launched the $5.1 million Wind Turbine Materials Recycling Prize to develop innovative, cost-effective recycling solutions.

Some companies are finding ways to repurpose turbine blade material. This includes:

- Upcycling: Carbon Rivers, with support from the DOE, uses a thermal process to reclaim fiberglass from blades for use in other composite products.

Image Courtesy: Carbon Rivers

- Repurposing: Attempts are being made to shred ‘blade materials’ to use as an additive in concrete, asphalt, or industrial products like manhole covers.

- Creative reuse: Old blades are being tried to use as building materials for playgrounds or infrastructure.

However, the composite nature of blades makes them technically difficult and expensive to recycle. Although landfilling is quite undesirable – but has been the common disposal method due to the blades’ massive size and volume.

Handling discarded lithium-ion batteries

The EPA recommends that businesses manage discarded lithium-ion batteries as a ‘universal waste’, which offers a streamlined process for recycling hazardous materials. Federal agencies, like the Pipeline and Hazardous Materials Safety Administration (PHMSA), have also issued guidance for the safe transportation of batteries for recycling.

Image Courtesy: ABTC

The U.S. battery recycling industry is expanding rapidly, with significant private investment and government grants supporting new facilities. Major recyclers like Ascend Elements, Cirba Solutions, and Redwood Materials are building capacity across the ‘battery belt’ in the Midwest and Southeast. They use some advanced methods to recover critical minerals like lithium, cobalt, and nickel. For example:

- Hydrometallurgy: A process that uses liquid solutions to efficiently recover high percentages of valuable minerals.

- Direct recycling: An emerging technology that recovers the cathode material intact, which is more energy-efficient and can lower recycling costs.

- Reuse and repurposing: Used EV batteries that have degraded but still function are being repurposed for a ‘second life’ in less demanding applications, such as stationary energy storage for homes or grid stabilisation.

However, adequate consumer awareness about proper battery disposal is still a major hurdle there. Mishandled batteries in household trash and recycling pose a fire hazard to waste and recycling facilities. The recycling industry must also scale up quickly to meet the future volume of end-of-life batteries.

How is Germany addressing the emerging challenges?

Germany has been addressing the challenge of disposing of RE products through a combination of strict regulations, developing advanced recycling technologies, promoting a circular economy, and extending manufacturer responsibility. The country is following specific strategies for managing waste from solar panels, wind turbines, and EV batteries as they reach the end of their operational lives.

Handling solar panel wastes

In Germany, a significant increase in solar panel waste is expected in the coming years, with volumes projected to nearly triple by 2035 and grow to nearly 10 million tons by 2050. The management strategy includes:

- WEEE Directive Implementation: Germany incorporates the European Waste Electrical and Electronic Equipment (WEEE) Directive into its national Electrical and Electronic Equipment Act (ElektroG), which covers Photovoltaic (PV) installations.

- Extended Producer Responsibility (EPR): This regulation holds manufacturers and distributors accountable for collecting and recycling at least 85% of their products by volume.

Recycling innovations: Private companies and startups are developing advanced recycling technologies to improve material recovery. For example:

- Solar Materials (formerly NGT Cleantech): This German startup is building its first industrial-scale plant, which aims to recover up to 98% of materials, including glass, silicon, silver, and copper, through a thermo-mechanical process.

- Reiling PV-Recycling: An established German glass recycler, Reiling, is expanding its facilities to handle up to 50,000 tons of PV modules annually, with recent progress in silicon recovery.

- Reuse: Modules that still function are sorted and resold on a second-hand market, often for export, extending their operational life.

Dealing with scrapped wind turbines

While about 90% of a wind turbine’s weight (steel and concrete) is already recyclable, the composite materials in rotor blades are difficult to recycle economically and pose a major challenge. German solutions include:

- Recyclable blade development: German offshore wind farms are testing recyclable blades designed by Siemens Gamesa. A new type of resin in these blades can be dissolved, allowing for the reuse of materials at the end of their lifecycle.

- Innovative materials: A German startup is manufacturing wind turbine blades from wood veneer to create a more sustainable and easily recyclable alternative to composite materials.

- Alternative processing: For conventional blades, the shredded material can be reused as an additive in concrete production or incinerated for energy recovery.

- Improved waste classification: The German Wind Energy Association (BWE) is pushing for better waste classification and harmonised European regulations to standardise the recycling of composite materials.

Treating rejected EV batteries

The rapidly increasing Electric Vehicle (EV) market presents a significant challenge for recycling lithium-ion batteries. Germany is addressing this with:

- Batteries Act (BattG): This law makes producers responsible for the collection and recycling of used batteries, setting a recycling efficiency target of 65% by weight for lithium-ion batteries.

Image Courtesy: Mercedes-Benz

- Second-life applications: Batteries from Germany’s EV sector are given a ‘second use’ by being repackaged into stationary energy storage systems before they are fully recycled.

- New recycling facilities: Major automakers and chemical companies are investing in new plants to close the material loop. For example:

– Mercedes-Benz: The company has opened a state-of-the-art battery recycling plant in Germany that can recover up to 96% of raw materials, with the goal of re-using the materials in new battery production.

- BASF: The chemical giant has recently started its Black Mass battery recycling plant in Schwarzheide to recover valuable materials like nickel, cobalt and lithium.

Image Courtesy: BASF

- Technological innovation: German companies are leading advancements in recycling technologies, including hydrometallurgical processes that can recover up to 95% of critical battery materials.

Before I put full stop today

Although not mentioned elsewhere, this article is the first part of a series of articles, which I am going to present in the coming issues of Electrical India. As the matter of proper disposal of RE-industry-wastes is of great concern today, I feel several aspects of it need to be disseminated for readers’ awareness. So, soon I’ll present the next article (with reference to it but under another headline) of this series on the activities of the Asian countries in this regard.

By P. K. Chatterjee (PK)