I don’t think there can be any disagreement that India’s power sector is progressing at a rapid pace under the supervision of our current government. Placing two ministers in charge of the power sector (Power + New & Renewable Energy) at the outset of forming the new government was undoubtedly a far-sighted decision. The benefits of which are now being witnessed.

India has the third-largest power sector globally in terms of electricity production and consumption, and it is a world leader in the growth of power generation capacity, particularly in renewable energy. Our country has achieved near-universal household electrification – and has set ambitious targets for non-fossil fuel capacity by 2030. In this article, I am trying to shed light on several significant changes that have occurred in India’s power sector in 2025, and some challenges that we still need to overcome.

Our power sector at a glance today

India has made significant progress in strengthening its energy (power) sector in recent years. Our country is successfully balancing the twin goals of meeting rising electricity demand and promoting sustainability.

According to the International Energy Agency (IEA), “85% of the increase in global electricity demand over the next three years will come from emerging and developing economies. As one of the fastest-growing major economies, India plays a central role in the global energy transition. Its energy demand is expected to grow at the fastest rate among major economies, driven by sustained economic growth. Consequently, India’s share in global primary energy consumption is projected to double by 2035.”

Over the past decade, India’s power sector has seen robust expansion driven by rising demand, infrastructure development, and strong policy support for both conventional and renewable energy sources.

A few notable facts

- Production and consumption: India is the world’s third-largest producer and consumer of electricity, following China and the United States.

- Growth: It ranks third globally in power generation growth over the past five years and is a leader in adding new capacity, driven significantly by renewables.

- Renewable energy: Our country is a major force in renewable energy, ranking fourth in renewable energy installed capacity, third in solar power, and third in wind and solar power generation combined. As of October 2025, over 51% of India’s total installed capacity comes from non-fossil fuel sources.

- Electrification: Our country has achieved near-universal household electrification, though the quality and reliability of supply can vary by region.

- Targets: Our nation is committed to a goal of 500 GW of non-fossil fuel capacity by 2030.

Significant progress in 2025

In 2025, our power sector has made significant strides, particularly in renewable energy, achieving its highest-ever renewable energy share in generation and surpassing 50% of installed capacity from non-fossil fuel sources ahead of schedule.

Key progress includes crossing 100 GW in solar capacity and 50 GW in wind capacity, the launch of reforms like the Electricity (Amendment) Bill, 2025, and an increase in solar module manufacturing capacity.

Renewable energy expansion

- Record renewable energy share: In July 2025, renewable sources supplied over 50% of the country’s total electricity demand for the first time.

- Installed capacity milestones: Our country has crossed 100 GW in solar capacity and 50 GW in wind power capacity.

- Solar power growth: India has become the world’s third-biggest solar energy producer, surpassing Japan.

- Increased manufacturing: Solar module manufacturing capacity has grown significantly, rising from 38 GW to 74 GW during the 2024–25 fiscal year.

Policy and reform

- Electricity (Amendment) Bill, 2025: New provisions have been introduced to reform the power sector, including regulating wheeling charges and defining the role of energy storage systems.

- Increased investment: The sector has seen a substantial investment of `84,309 crore in the first quarter of 2025.

Grid and infrastructure

- Grid modernisation: Efforts are now underway to modernise the grid through smart grid pilots and the deployment of technologies like bifacial solar panels and AI-driven forecasting platforms.

- Improved reliability: Electricity shortages fell sharply to 0.1% in FY25 from 4.2% in FY14, indicating improved supply reliability.

- EV charging integration: The integration of solar power with Electric Vehicles (EVs) is expected to grow significantly, leading to more solar-powered EV charging stations.

Strong growth in total capacity

As per International Energy Agency (IEA), “Electricity demand in India has been rising sharply due to increases in commercial and residential space, a surge in ownership of air conditioners and appliances, and rising demand from industry. India has seen the third-largest growth in power generation capacity in the world after China and the United States over the past five years. While growth in power generation has come from all sources, there has been a surge in investment in renewables, led by solar PV, which constitutes more than half of total non-fossil investment over this period. In 2024, 83% of power sector investment went to clean energy. India was also the world’s largest recipient of development finance (DFI) funding in 2024, receiving around USD 2.4 billion in project-type interventions in clean energy generation. This helped bring the share of non-fossil power generation capacity to 44% in 2024, approaching India’s target of 50% by 2030.” However, India has achieved more than 50% of its installed power capacity from non-fossil fuels in June 2025, ahead of its 2030 target.

Foreign direct investment status

According to IEA, “India has announced a range of measures to facilitate and support investment in non-fossil power generation, domestic manufacturing of key energy components such as batteries and solar PV modules, and in transmission and distribution. While a large share of the investment in India’s power generation capacity and transmission networks is met by domestic sources, Foreign Direct Investment (FDI) has been growing steadily, reaching USD 5 billion in 2023, nearly double the pre-coronavirus (Covid-19) levels. This is promoted in part by rules permitting 100% FDI across electricity generation sources (with the exception of nuclear) and transmission infrastructure. However, foreign portfolio investment in energy has declined in the past two years due to a range of macroeconomic and sectoral factors, even as the longer-term trend has been one of steady growth.”

Is the domestic investment enough?

Although the Indian power sector is progressing quite satisfactorily, it is yet to receive enough finance from domestic investors to meet its massive investment needs. However, significant capital is being mobilised at present.

Domestic financial institutions and government-owned NBFCs like PFC, REC and IREDA are major sources of debt, still, there is a substantial gap between projected demand and current supply. The sector requires more infusion of private capital.

A few key achievements and progress in 2025

India’s power sector has achieved two historic milestones that show our nation’s steady progress toward a clean, secure and self-reliant energy future.

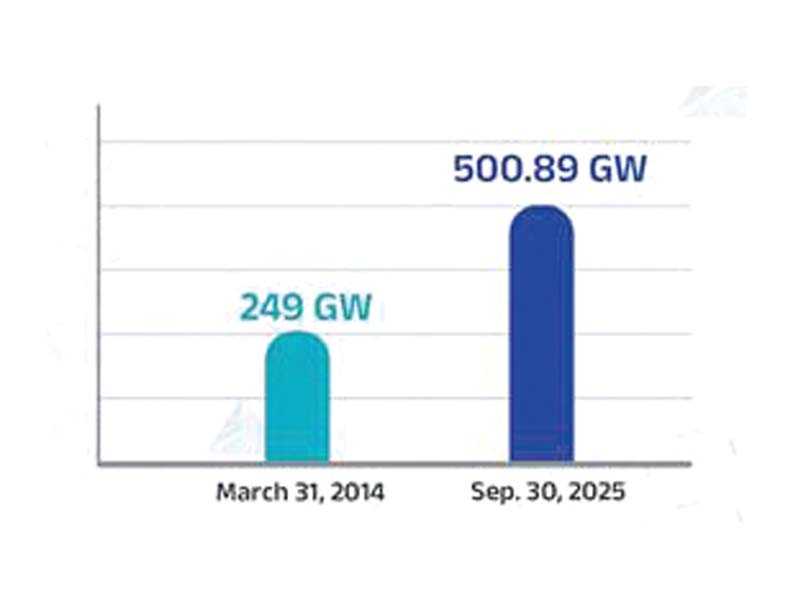

As of September 30, 2025, our country’s total installed electricity capacity has crossed 500 GW, reaching 500.89 GW. This achievement reflects years of strong policy support, investments and teamwork across the energy (power) sector.

A summary of the major developments

- Milestone achievements: As of September 2025, India’s total installed electricity capacity has surpassed 500 GW. Critically, non-fossil fuel sources (renewables, hydro and nuclear) now account for over 51% of this capacity, a goal achieved five years ahead of the 2030 target set at the COP26 climate conference.

- Renewable energy surge: India ranks globally as the 4th largest in renewable energy installed capacity, 4th in wind power, and 3rd in solar power capacity. The installed renewable energy capacity has nearly tripled in the last decade.

- Reduced power shortages: Energy shortages have significantly dropped from 4.2% in 2013-14 to a minimal 0.1% in 2024-25, indicating improved supply reliability.

- Universal access: Our country has achieved 100% village electrification by April 2018 and has since connected over 28 million households to the grid through schemes like the Saubhagya program.

- Increased consumption and infrastructure: Per capita electricity consumption has increased by over 45% in the last decade, and the national power grid has been unified and strengthened.

- Policy support: Government initiatives like the PM Surya Ghar: Muft Bijli Yojana are promoting rooftop solar and empowering consumers as energy producers, supported by substantial financial outlays.

Before I leave

As our power sector will require an estimated `4.5-6.4 lakh crore investment until FY35 – more investment, especially from domestic investors, is required.

As per IEA, “India’s cost of capital for grid-scale renewable energy is one of the lowest among its emerging market and developing economy counterparts. However, it is still 80% higher than in advanced economies.” This aspect should be addressed immediately.

The rapid expansion of variable renewable energy (solar and wind) is outpacing the grid’s ability to manage intermittent supply, creating instability and potential power shortages, especially during peak evening hours. The development of large-scale energy storage systems (pumped hydro and batteries) and smart grid technologies is crucial but still nascent.

Still there is a significant lag in the development of Transmission and Distribution (T&D) infrastructure relative to generation capacity. Issues like land acquisition delays, slow project approvals, and right-of-way issues hamper the evacuation of power from resource-rich areas to demand centres. These issues need to be looked upon.

Inconsistent policies across different states, delays in determining cost-reflective tariffs, and a complex regulatory framework are creating an unpredictable environment for private investors. The ongoing push for the Electricity (Amendment) Bill, 2025, aims to address some of these issues by promoting competition and financial discipline. However, it is still facing opposition from various groups who fear it will lead to privatisation and higher tariffs. This issue must be cleared ASAP.

We are stepping into 2026, thus to fulfil our commitments for 2030; which are: to achieve 500 GW of non-fossil fuel-based electricity capacity and reduce the emissions intensity of its GDP by 45% from 2005 levels; addressing the above issues is very urgent.

By P. K. Chatterjee (PK)