IPDS has sanctioned projects aggregating Rs 320 billion for system strengthening, IT implementation, ERP, smart metering, distribution automation system etc. What is the status of these projects and how will these projects bring transition in the country’s energy sector?

IPDS scheme was launched to supplement the effort of States in the power distribution sector. It envisages strengthening of distribution infrastructure, digital technologies and new interventions keeping in mind land constraint in urban areas.

The scheme is playing a key role in removing the bottlenecks in power supply due to capacity constraints of distribution networks. We have achieved a progress level of more than 75 per cent on all India basis in case of system strengthening projects.

IT enablement of Discoms achieved in bigger towns has improved business process flow and led to automation in several key operational aspects in Discoms and has also eased the life of a common man. A common toll free number for electricity complaints “1912” has been implemented in the entire country. Multiple Payment options are now available and consumers are making full use of the same. States are in the process of extending the IT based systems in around 2000 smaller towns. ERP implementation for improving operational efficiencies in the Discoms has already been completed in Discoms of AP, Jharkhand and MP.

With such a massive thrust on strengthening of distribution infrastructure, it is expected that availability and quality of power on the last mile would improve in the urban areas thereby, contributing to the Government‘s vision of 24×7 Power for All. At the same time, interventions like underground and AB cabling, smart metering etc are helping in AT&C (Aggregate Technical & Commercial) loss reduction.

We have so far been able to reach out to over 30 million urban consumers in around 2100 odd towns where the work has been completed, with better power in terms of quality and reliability.

What is your assessment of power transmission and distribution sector during last year?

Sustained economic growth and burgeoning energy demand continue to drive the expansion of the country’s power sector.

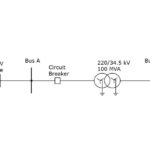

The power transmission network in India has grown significantly over the past few years driven by the need to support the growing load and provide connectivity to generation projects with around 0.4 million ckm of transmission (220 kV and above voltage levels) line length and 0.9 million MVA of transformer capacity (220 kV and above voltage levels) being achieved by August 2019. As of March 2019, India’s inter regional power transfer capacity stood at over 99 GW with an addition of over 12 GW during last one year or so.

Grid expansion is being driven by the Government’s ambitious plans like 100 per cent electrification of its broad-gauge rail routes and scaling up renewable energy. To develop associated power evacuation infrastructure, Powergrid along with State utilities is implementing the Green Energy Corridor project to connect new solar and wind capacity. As recently as August 2019, CERC has proposed several amendments to the framework for real-time market, an important development given the large scale integration of intermittent renewable energy into the grid and the changing demand patterns. The distribution segment has reported good performance over the past year with near 100 per cent electrification under Saubhagya and an improvement in operational efficiency of different Discoms being the high points.

In order to achieve the aim of ensuring 24×7 Power for All, substantial amount of modernisation, restructuring, and upgradation of the sub-transmission and distribution infrastructure including commissioning of new substations, lines, energy efficient distribution transformers, separation of agricultural and non-agricultural feeders to facilitate judicious supply of power to agricultural and non-agricultural consumers in rural areas has been undertaken under IPDS and DDUGJY schemes of Government of India.

On the front of better governance and move towards digitalisation, the Ministry of Power through portals like National Power Portal (NPP) and various apps has brought higher transparency. This has enabled online tracking of the performance of the entities in the value chain.

Significant progress has been made in smart metering with the installation of over 600,000 smart meters in Bihar, NDMC (New Delhi), Haryana, MP and Uttar Pradesh. The Ministry of Power has also issued an advisory to all Discoms to draw up a roadmap for switching to smart meters in prepaid mode over a period of three years.

Further, to bring about reform in the segment, the Ministry of Power has recently mandated Discoms to open and maintain a letter of credit (LC) as a payment security mechanism for Gencos.

Very recently, ‘Getting Electricity’ in India with a ranking of 22 has been declared one of the highest ranked indicator as per World Bank’s Doing Business Report (DBR,2020) and the same has been made possible due to several administrative easing measures initiated by the Ministry of Power, State Governments and the State power discoms.

Distribution losses continue to remain high affecting the viability of the entire power value chain. What are the policy measures taken by IPDS to curtail these losses?

Power distribution sector is still struggling for lot of inefficiencies in the distribution due to AT&C losses. Also, there is a long way to go for achieving 24×7 availability front in non-metro cities, semi-urban areas. AT&C losses correspond to electricity produced but not paid for and are one of the main indicators of Discoms’ health. AT&C losses are caused by a variety of problems, including energy sold at low voltage, improper load planning, inadequate investments in the distribution system, improper billing and theft.

Under IPDS, State Discoms are implementing more than 65,000 ckm of aerial bunched cabling, 20,000 ckm of underground cabling, 8.5 million static meters which amongst other system strengthening work will facilitate reduction of losses. Further, distribution utilities must focus their attention and resources on inside-out digitalisation of business processes by investing heavily in IT and IT-enabled solution technologies to automate routine and repetitive activities. IT enablement of smaller towns shall help in proper energy accounting and auditing of these towns and will form the backbone for smart metering projects. With implementation of around 4 million smart meters sanctioned under IPDS, Discoms will be in a position to engage with customers, meet peak demand and increase billing efficiency. Greater transparency and accountability will come into the system and will aide in reducing AT&C losses.

What are the biggest challenges in the power T&D sector that need urgent policy attention?

The power transmission segment has been evolving in line with the increasing power demand and the changing energy mix due to the influx of renewables. Going forward, a substantial investment is required in transmission alone to meet the future peak load, which is expected to reach 234 GW by 2021-22.

Several challenges need to be resolved to ensure the timely implementation of grid expansion plans. From a grid planning point of view, these challenges pertain to the short gestation period of renewable energy plants, reactive power management, fault level at the point of interconnection, the diversity of resources, and the quantum of renewable energy generation. Grid integration of large scale solar or wind generation capacities requires balancing actions because of natural intermittency of such generation. Due to the lack of harmonisation of policies and regulations across different States, securing right of way (RoW) continues to remain a key concern for all project developers with environmental and forest clearances being the leading challenges in project development. The large-scale capacity addition and connection of millions of new consumers to the grid requires robust grid planning. Further, system operators and regulators need to be empowered to ensure effective implementation of relevant policies and regulations.

The augmentation of transmission infrastructure, particularly, Green Energy Corridors at the intra- State level, need to be accelerated to ensure that the Government’s renewable energy and Power for All goals are met. This coupled with the implementation of power system operation reforms in the States will help in building a more flexible and robust grid equipped to support the shift in generation mix and distribution loads.

Restoration of the financial health of Discoms and improvement of their operating performances remain the critical issue for the distribution sector. Challenges such as inadequate tariff hikes (leading to high ACS – ARR gap), significant cross-subsidisation, minimal private participation, and delay in metering also continue to hamper the distribution segment’s progress.

Going forward, the focus needs to be on not just structural and policy changes, reforms to increase competition but also on the technological evolution of the distribution segment. We will need schemes which focus on all three aspects – people, policy and technology. Since communication forms the backbone of any technology solution, thought needs to be given on this aspect. The schemes also need be linked to Discoms’ performance, and funds may be released only if operational and financial targets are met. As such, effective implementation of the schemes and restructuring package will remain the key.

According to you, how technology and innovations can bring transformations in the T&D ecosystem?

Over the last few years, there has been a very significant increase in the use of technology by power sector in India. The transmission segment is also steadily making its way up the technology curve. The transmission grid is witnessing the adoption of state-of-the-art technologies such as wide area monitoring systems based on phasor measurement units.

The increase in use of technology in sub-transmission and distribution sector was driven primarily by the Restructured Accelerated Power Development and Reforms Programme (R-APDRP), which is now a part of the Integrated Power Development Scheme (IPDS). Several technology solutions are being deployed to improve the business processes and operations of utilities including SCADA/ DMS, Real Time Data Acquisition (RT-DAS) for capturing SAIFI or SAIDI at substation level, ERP, sensor technologies among others. At the core of the industry’s technology transformation are smart metering systems. Two-way data communication systems established through smart meters can be leveraged for providing data on load forecasts, optimising consumption, as well as improving customer engagement, among other things. Presently, the Indian power sector is changing much faster than expected. Decentralised generation, prosumerism, a rapid influx of renewables, proliferation of intelligent devices, launch of electric vehicles are driving Discoms to look at innovative ways to engage with its customers. Traditional T&D networks are evolving towards smarter grids, while greater choice in energy supply and use is expected to create new marketplaces. With all the above in place, technology and innovation is expected to play a key role to help T&D businesses extract value from it.

Where do you see India’s power sector in next two years?

Power sector is at an exciting phase now and going forward it is expected that the demand will grow to cater to the continued economic growth of the country, creating more volume in the power market with strengthening of financials of Discoms. Also, increasing population and growing penetration of electricity connections, along with increasing per capita usage would provide further impetus to the power sector. The demand is also likely to come from shift of usage from fuel to electricity in transport and agriculture sector in particular from distributed generation with solar installations. Electric vehicles and chargers have penetrated almost every State, and smart meters are rapidly making headway into homes. To address the new challenges and opportunities, Discoms will also have to consider new solutions that can help deliver better services as well as improve productivity, resource management and ensure load optimisation.

Any transformation requires concerted efforts and there is a need for every stakeholder to contribute towards revolutionising India’s power sector which will contribute in a big way to achieve the Prime Minister’s target of becoming a USD 5 trillion economy by 2025.