Rise in share of renewable energy is likely to be gradual and continuous, as the government targets 175GW by FY2022. Prime Minister Narendra Modi has indicated that renewable target will be 450 GW subsequently. The Central Electricity Authority (CEA) indicates that grid could have 450 GW of renewable power in FY2030 compared to 82 GW installed as on 31st August 2019.

Thermal capacity addition has slowed down subsequent to capacity excess created in comparison to demand. PLF hit an all-time low of 60 per cent in FY2017 and has been inching up since then. Increase in thermal PLF is due to slower pace of capacity addition compared to demand increase in last two years. Slow pace of capacity addition is positive for existing thermal plants, especially the stressed thermal plants, as possibility of signing remunerative power purchase contracts increases. PLF is likely to increase slowly up to 65 per cent in next few years, if demand increase continues at about 6 per cent per annum.

CEA’s indicative generation mix for FY2040 has 50 per cent share of thermal power, implying a slow generation growth of 2 per cent per annum.

Driver for new generation capacities is the demand projection for the country over next decade. Projected demand for FY2040 is 2,508 billion units (BU), implying CAGR of 5.6 per cent per annum growth from FY2019-2040.

Large multinational companies are already shifting to renewable energy purchases and the trend is likely to continue internationally. A similar trend might catch on in India, as climate change concerns are highlighted and felt across the country.

Demand Drivers: Urbanisation, Electrification Goals & Electric Vehicle

The basic demand drivers for electricity are the underlying economy, enabled by increase in reach of electricity through Saubhagya scheme. Energy security being a concern, especially in the context of oil imports, government is likely to champion electrification of as many economic activities as possible. The demand projection would be sensitive to electrification of transport and agriculture and allied activities. Increasing share of electricity in overall energy mix (among the energy sources – oil, gas and electricity) will be positive on current account deficit.

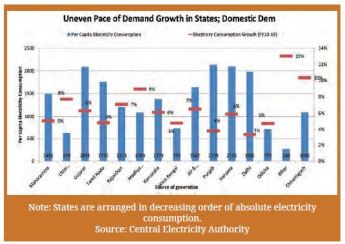

Demand increase is inevitable when comparing the per capita consumption across states. The populous states – Uttar Pradesh and Bihar – still have a very low per capita consumption, A significant demand driver will be these states catching up with the national average per capital consumption. States with higher per capita consumption attract industrial investments easily and also additional investments in projects such as lift irrigation (Andhra Pradesh and Telangana) contribute to demand growth.

An estimate indicates that 500 billion units could be the demand from electrification of entire road transport at current level of electric vehicle efficiency. Share of electricity demand because of electric vehicle penetration is surely likely to increase, albeit in an uncertain pace.

Enabling investments is key to energy security

Rs17,000 crore annually (calculated at Rs 4.5 crore per annum) of investment is required for meeting the targeted renewable capacity addition of about 37GW annually till FY2030. Compared to this, peak annual renewable capacity addition was 11 GW each in FY2017 and FY2018. To meet our country’s goals, significant measures on three aspects are required.

• Financing equity and debt

Foreign investors have made significant contribution to renewable energy growth in the country. These investors need a clear exit path for continuing investments. The major option for exit has been selling capacities to another larger player (Ostro sale to Renew Power, Orange sale to Greenko Group, etc). For companies targeting to become an integral player in power sector, listing could be a good option. Infrastructure Investment Trust (InvIT) is likely to be a go to option for developers who want to exit a project once they are commissioned. Equity churning is required for meeting the capacity additions target.

Debt financing has become a constraint in recent times given the liquidity challenges in the financing market. Large renewable players have opted for dollar financing to refinance the portfolio with long-tenor, higher debt. Lack of sufficient depth and risk-taking ability in domestic bond market limits the opportunities in refinancing in Indian bond market. While higher debt enables release of some equity, unusually high debt could be risky for the company, given the continuing hiccups in the industry; uncertain payments from distribution companies (DISCOM) and grid curtailment possibilities.

• Easing processes and adequate infrastructure for setting up renewable plants

Ease of land acquisition, timely open access and grid infrastructure and management to enable renewable capacity addition and integration are likely to invite investments in renewable.

• Matching the generation capacity with demand; aiding discoms in optimised demand and supply planning

Continuing troubles caused by discoms tying to renegotiate power purchase agreements is a major deterrent for investments in India. While the state’s intention is to reduce the cost of power for its citizens by renegotiating PPAs, the opposite is likely to happen because of such actions. Risk of renegotiation may need to be priced and future renewable tariffs could get higher. A co-ordinated effort is needed to align the goals of energy security, climate action and making availability of economical energy in the country.

India provides a significant opportunity for investors in generation capacities and the energy demand growth of 5-6 per cent is inevitable. Ironing out the issues in DISCOM health and financing could propel the market and will ensure reliable and sustainable power supply. Generation cost forms more than 80 per cent of the bill paid for electricity and hence optimising the generation cost through various measures is likely to have the maximum impact on overall electricity cost during next two decades.

Divya Charen C

Senior Analyst – Infrastructure & Project Finance

India Ratings & Research